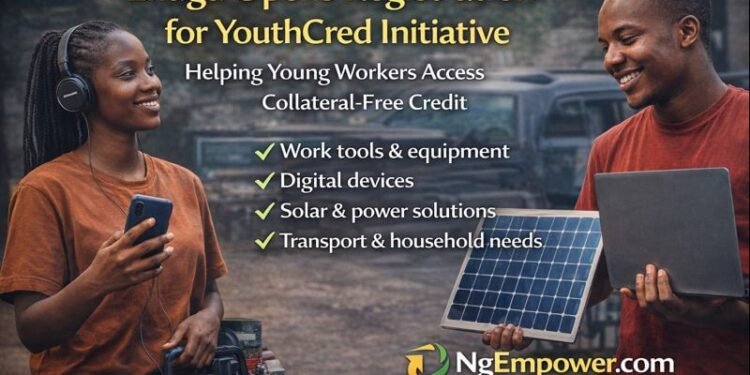

Registration has opened in Enugu State for the YouthCred Initiative, a Federal Government consumer credit programme created to help young Nigerians access affordable, collateral-free loans to support their work and everyday productivity.

The initiative is part of a broader national effort to expand access to fair credit and reduce the difficulties many young people face when trying to finance work tools, digital devices, transport, and other essentials needed to earn a living.

What YouthCred Is and How It Works

YouthCred is implemented through CrediCorp, Nigeria’s national consumer credit institution established to support responsible lending and long-term financial inclusion. The programme focuses on working Nigerians, especially youths, who earn income but are often shut out of formal credit because they lack collateral or guarantors.

Rather than relying on informal lenders or high-interest loans, YouthCred provides a structured way for beneficiaries to access credit while building a repayment history that can support future financial opportunities.

Enugu State’s Role in the Programme

In Enugu, the YouthCred Initiative is being rolled out under the administration of Governor Peter Ndubuisi Mbah. The programme is coordinated by the Enugu SME Center and Office of Digital Economy, also known as the Enugu MSME and Startup Agency.

The state government has positioned the initiative as part of its wider push to improve productivity, support small businesses, and strengthen digital participation among young professionals. By linking YouthCred to its MSME and digital economy framework, Enugu aims to ensure that young workers can access credit in ways that directly support income growth and stability.

Registration Has Begun

Confirming the commencement of registration, Arinze Chilo-Offiah, Special Adviser to the Governor on Digital Economy and MSMEs and Director-General of the Enugu SME Center, said the programme is now open to eligible youths across the state.

He explained that YouthCred was introduced to give young people access to structured credit that helps them improve how they work and earn. According to him, the programme is designed to remove common barriers that prevent many working youths from accessing formal loans.

We have published a guide on Direct Link to Apply for YouthCred Loan for Nigerian Youth ( FG Loan without Collateral )

What the Credit Can Be Used For

Under the YouthCred Initiative, approved beneficiaries can access credit to meet practical needs linked to work and daily living. These include:

Tools and professional equipment needed for work

Digital devices such as phones, laptops, and tablets

Solar and power solutions to improve energy access

Transport and mobility needs

Essential household and personal expenses

The idea is to support spending that improves productivity and reduces pressure on income, rather than encouraging unnecessary consumption.

Removing Barriers Young People Often Face

Many young Nigerians rely on personal savings or informal borrowing to meet basic work needs. Traditional loan systems often require collateral or guarantors, conditions that exclude a large number of employed youths.

YouthCred is structured to address this gap by offering credit without collateral, while still promoting discipline through a clear repayment structure. The programme also discourages exposure to predatory lending by providing a regulated alternative that is easier to understand and manage.

By focusing on responsible borrowing, YouthCred helps participants build a credit profile that can be useful beyond the immediate loan.

Who the Programme Is For

The initiative is targeted at employed youths in Enugu State who need access to credit to support their work, improve efficiency, or manage essential expenses.

Registration is done online, and applicants are expected to provide accurate information and follow official instructions as provided by the Enugu SME Center and YouthCred administrators.

Part of a Broader Youth Support Drive

The launch of YouthCred registration in Enugu adds to a growing list of programmes focused on youth empowerment, MSME support, and digital-driven economic participation in the state.

Officials say the programme reflects a practical approach to supporting young workers—by addressing everyday financial challenges that affect productivity rather than offering short-term relief.

As registration continues, eligible youths in Enugu are being encouraged to learn more about the initiative and apply through approved channels, while staying informed through official state and programme updates.

YouthCred joins other Federal Government efforts aimed at expanding access to credit in a way that supports sustainable livelihoods and long-term economic participation for young Nigerians.

💡 Stay Empowered with NgEmpower

Join our community for daily updates on jobs, skills, and financial growth opportunities.