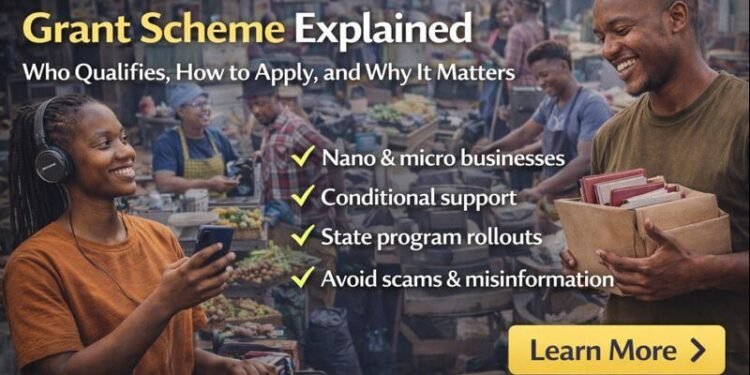

The SMEDAN Conditional Grant Scheme is one of the most talked-about government support programmes for small businesses in Nigeria. Many traders, artisans, and micro business owners hear about it through word of mouth, WhatsApp messages, or roadside discussions, often mixed with rumours and half-truths.

Some believe it is “free money for everyone.” Others think it is no longer real. Many are unsure how to apply or whether they even qualify.

This guide breaks everything down clearly, who SCG scheme is for, how it works in real life, how applications actually happen, and why the programme exists in the first place.

If you’re new to SMEDAN and how it supports Nigerian businesses, you can first read our complete guide to SMEDAN and its programmes on NGEMPOWER, then continue with this detailed explanation of the Conditional Grant Scheme.

What Is the SMEDAN Conditional Grant Scheme (CGS)?

The SMEDAN Conditional Grant Scheme, often shortened to CGS, is a government support programme created to assist nano and micro businesses across Nigeria.

It is coordinated by the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) but usually implemented in partnership with state governments, local authorities, cooperatives, and business.

The scheme was introduced to provide small, targeted financial support to very small businesses that struggle to access loans or formal funding.

A key point many people miss is this:

The CGS is conditional support, not a general cash giveaway.

It is also important to know that the programme is not always open nationwide at the same time. Rollouts often depend on budget approvals, state participation, and local implementation plans.

Why the Conditional Grant Scheme Exists

Across Nigeria, millions of small businesses operate at survival level. These include roadside traders, market women, artisans, food vendors, and service providers who may not need large loans but still struggle with basic business needs.

Common challenges include:

Lack of small working capital

No access to bank loans

High cost of tools, equipment, or inventory

Limited financial records

Vulnerability to economic shocks

The CGS was designed to address these realities. Instead of loans that come with interest and pressure, government provides small grants tied to specific conditions, such as business verification, training, or equipment use.

This approach helps stabilize businesses, encourages accountability, and supports grassroots economic activity, which is a major driver of jobs and income in Nigeria.

Who Qualifies for the SMEDAN Conditional Grant Scheme?

The CGS is not for everyone, and understanding eligibility helps prevent disappointment.

Generally, the scheme targets:

Nano and micro businesses (very small businesses)

Traders, artisans, service providers, and informal operators

Businesses already operating, not just ideas

Owners registered with SMEDAN

Businesses located in states where CGS is currently being implemented

In many cases, beneficiaries are selected through:

Cooperatives

Market associations

Artisan clusters

Local government business groups

Basic requirements often include:

SMEDAN registration

Valid identification

Business location details

Participation in verification or training exercises

Those who usually do not qualify include:

Medium or large businesses

Individuals without any existing business

Applicants expecting automatic approval

People unwilling to participate in verification or monitoring

Benefits of CGS

Participants in the Conditional Grant Scheme (CGS) for micro enterprises receive financial assistance tailored to their business needs.

As of 2025 these nano businesses get a sum of ₦50,000 grant on the condition of employing one person in order to encourage job creation.

How the Conditional Grant Works in Practice

The Conditional Grant Scheme usually provides small grant amounts, often modest but targeted. The exact amount varies depending on funding, location, and programme design.

What matters more than the amount is how the grant is used.

Conditions attached to the grant may include:

Attending basic business or financial training

Using the funds strictly for business purposes

Purchasing approved tools, equipment, or inventory

Allowing follow-up monitoring or verification

The grant is not a right or entitlement. Selection is based on programme criteria, available funding, and implementation guidelines.

How to Apply for the SMEDAN Conditional Grant Scheme

Application is usually done on CGS – Conditional Grant Scheme For Micro Enterprises portal or at the local goverment of each state approved for it.

Step 1: Register with SMEDAN

You must have a SMEDAN Business ID.

Proceed to the CGS section – https://smedan.gov.ng/our-programs/cgs/

(You can read our step-by-step guide on how to register with SMEDAN on NGEMPOWER.)

Step 2: Monitor Official Announcements

CGS opportunities are often announced through:

SMEDAN offices

- SMEDAN Portal

State government channels

MSME clinics

Cooperatives and business associations

Step 3: Participate Through Approved Channels

Many applications are done offline or through local structures.

Step 4: Verification

SMEDAN or state officials may:

Visit business locations

Verify operations

Confirm business details

Step 5: Selection and Disbursement

Only verified and approved beneficiaries receive grants.

Important warnings:

Application is free

SMEDAN does not require agents

Any request for payment is a red flag

WhatsApp links promising guaranteed grants are likely scams

Common Myths and Scams Around the CGS

Several false claims circulate regularly, including:

“SMEDAN gives everyone free money”

“Pay an agent to fast-track your grant”

“Apply here for nationwide CGS now”

“Guaranteed SMEDAN grant approval”

These claims are misleading. The CGS is real, but it is limited, structured, and conditional. Protect yourself by relying only on verified sources like NGEMPOWER and official SMEDAN channels.

What Beneficiaries Should Expect

The Conditional Grant Scheme is support, not full business capital.

Beneficiaries should expect:

Small but helpful financial assistance

Guidance on proper use of funds

Encouragement to keep simple records

Opportunities to participate in future programmes

When used well, CGS support can help a business stabilize, improve operations, and become eligible for larger opportunities later.

How CGS Connects to Other SMEDAN Programmes

The CGS does not exist alone. It often links to other SMEDAN activities such as:

MSME clinics and trainings

Business formalisation support

CAC registration awareness

Partner funding through institutions like BOI or NIRSAL

You can explore these connections further in our main SMEDAN guide on NGEMPOWER.

Frequently Asked Questions

Is the SMEDAN Conditional Grant a loan?

No. It is a grant, not a loan.

Is the scheme nationwide?

Implementation depends on state participation and funding cycles.

Can I apply online?

Sometimes, but many applications happen through local channels.

How long does approval take?

It varies. There is no fixed timeline.

Can I apply more than once?

Policies differ by programme cycle.

Is the scheme available every year?

Yes. Availability depends on government funding.

How much is usually given?

50,000

Do I need CAC registration?

Yes

Conclusion

The SMEDAN Conditional Grant Scheme is real, but it is often misunderstood. It is designed to support small businesses that meet specific criteria, not to distribute money indiscriminately.

Understanding how it works, who qualifies, and how to apply helps you avoid scams and wasted effort. Following official channels and staying informed is the best approach.

NGEMPOWER remains committed to providing clear, verified, and practical information on SMEDAN programmes and other government opportunities. You can explore our full range of SMEDAN guides and updates to stay informed and prepared.

💡 Stay Empowered with NgEmpower

Join our community for daily updates on jobs, skills, and financial growth opportunities.