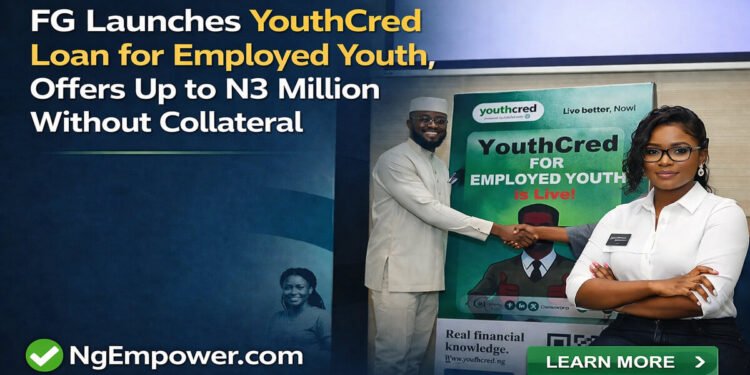

The Federal Government has officially launched the Employed Youth Phase of YouthCred, a new credit window that provides up to N3 million in consumer loans for young working Nigerians aged 18 to 39.

The initiative, announced in Abuja by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, aims to expand access to affordable credit for young people who earn steady income but struggle to obtain loans due to structural barriers in the financial system.

YouthCred is delivered through the Nigerian Consumer Credit Corporation (CREDICORP) in partnership with approved financial institutions. Unlike traditional financing, the YouthCred loan requires no collateral, making it easier for employed youths in both the public and private sectors to access credit for essential needs.

What the YouthCred Loan Can Be Used For

Eligible young Nigerians can apply for financial support to cover:

Mobility (cars, bikes, etc.)

Solar home systems

Rent support

Digital devices and laptops

Household equipment and upgrades

Work tools and productivity assets

This aligns with the government’s plan to support youth productivity and financial independence.

“A Credit-Enabled Economy Is Essential” — Wale Edun

Speaking at the launch, Minister Edun described YouthCred as “a practical expression of President Bola Ahmed Tinubu’s vision for a modern, credit-enabled economy where young Nigerians can live productive, dignified lives.”

He emphasized that the government’s economic reforms are designed to improve living conditions, particularly for young people who make up more than 65% of Nigeria’s population.

Edun added that with growing investment in digital infrastructure, young Nigerians “no longer need to ‘japa’ to succeed. You can build your future here.”

He also noted that Africa is projected to provide 25% of the global workforce by 2050, with Nigeria playing a major role.

CREDICORP: YouthCred Is Becoming a National Movement

CREDICORP Managing Director, Uzoma Nwagba, explained that YouthCred has evolved from a small pilot into a nationwide platform driven by strong public interest.

Highlights include:

The earlier NYSC-focused phase recorded 51,000 applicants who completed credit education.

Many beneficiaries successfully obtained loans.

CREDICORP has reached 200,000 Nigerians with N30 billion in consumer credit.

The initiative has achieved zero non-performing loans, which Nwagba attributed to proper credit education and responsible lending.

According to him, the expansion to employed youth will allow YouthCred to reach one million young Nigerians, making it the most affordable and structured consumer credit programme in the country—without collateral.

“YouthCred is not just about loans; it is a movement that teaches financial responsibility and opens doors,” Nwagba said.

How to Apply for YouthCred

Visit the Credicorp website : https://www.youthcred.com/

To qualify, applicants must:

Be between 18 and 39 years old

Be employed (public or private sector)

Complete the mandatory credit education programme

Apply digitally through CREDICORP-approved channels

This process ensures that beneficiaries understand how credit works and can responsibly manage repayment.

What the Government Says This Will Achieve

The Federal Government noted that YouthCred is designed to strengthen:

Financial inclusion

Youth empowerment

Consumer credit access

Economic productivity

Middle-class growth

By providing structured and affordable loans, Nigeria hopes to accelerate job creation, reduce financial stress on young workers, and support the emergence of a credit-driven economy similar to what exists in developed countries.

💡 Stay Empowered with NgEmpower

Join our community for daily updates on jobs, skills, and financial growth opportunities.