If you run a small business in Nigeria, plan to start one, or already operate informally, you have likely heard the name SMEDAN. Many people associate it mainly with grants or government programmes, but few truly understand what it does, who it is meant for, and how Nigerian entrepreneurs can benefit from it legitimately.

This comprehensive guide explains everything you need to know about the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) in clear, practical terms. It covers what SMEDAN is, what it actually offers, who qualifies, how registration works, and how to access real opportunities while avoiding common mistakes.

By the end of this guide, you will clearly understand how SMEDAN fits into Nigeria’s business ecosystem and how to position your business to benefit properly.

What Is SMEDAN?

SMEDAN stands for the Small and Medium Enterprises Development Agency of Nigeria. It is a Federal Government agency established in 2003 under the SMEDAN Act to promote the development of Micro, Small, and Medium Enterprises (MSMEs) across Nigeria.

SMEDAN does not replace banks, the Corporate Affairs Commission (CAC), or tax authorities. Instead, its role is to support businesses by improving access to training, funding programmes, partnerships, market opportunities, and business development services.

In simple terms, SMEDAN exists to help Nigerian businesses start better, grow stronger, and survive longer.

What Does SMEDAN Do?

SMEDAN’s activities directly affect everyday Nigerian entrepreneurs in several important ways.

MSME Development

SMEDAN designs programmes that help micro, small, and medium businesses improve productivity, business structure, record-keeping, and long-term sustainability.

Business Formalisation Support

Many Nigerian businesses operate informally. SMEDAN supports the transition to structured operations by guiding entrepreneurs on registration, documentation, and compliance requirements.

Capacity Building and Training

Through MSME clinics, workshops, and bootcamps held across states and local governments, SMEDAN provides practical training on:

- Pricing and costing

- Bookkeeping and basic accounting

- Marketing and customer management

- Digital tools for small businesses

Access to Finance Support

SMEDAN does not lend money directly. Instead, it collaborates with institutions such as the Central Bank of Nigeria (CBN), Bank of Industry (BOI), NIRSAL, development partners, and state governments to connect MSMEs to loans, grants, and intervention programmes.

Market Access and Business Linkages

Through trade fairs, expos, cooperatives, and partnerships, SMEDAN helps MSMEs find buyers, suppliers, and growth opportunities beyond their immediate local markets.

Policy Advocacy

SMEDAN represents the interests of MSMEs in policy discussions, helping government design policies that support small businesses, job creation, and economic growth.

Key SMEDAN Programmes and Initiatives

SMEDAN operates and supports several programmes. Below is an overview; each programme is explained in detail in separate NGEMPOWER guides.

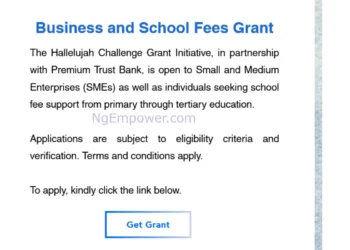

SMEDAN Conditional Grant Scheme (CGS)

One of the most popular interventions, the Conditional Grant Scheme provides financial support to nano and micro businesses, often implemented through state governments and cooperatives.

MSME Clinics and Training Programmes

Regular business clinics held nationwide where entrepreneurs receive training, advisory support, and sometimes on-the-spot business registration assistance.

Youth and Women-Focused Programmes

Targeted initiatives that support women-owned businesses, youth-led enterprises, and vulnerable groups through training and access to opportunities.

Partnership-Based Programmes

SMEDAN works with BOI, NIRSAL, CBN, development agencies, and state governments to deliver funding, equipment, and capacity-building interventions.

Digital and Informal Sector Support

Programmes aimed at traders, artisans, and informal businesses to help them adopt digital tools and transition into structured operations.

SMEDAN Grants, Loans, and Funding Explained

Funding is one of the most misunderstood aspects of SMEDAN.

Grants vs Loans vs Interventions

- Grants: Non-repayable funds, usually small amounts, tied to conditions such as training participation or business verification.

- Loans: Repayable funds provided by partner institutions, not directly by SMEDAN.

- Interventions: Broader programmes that may include training, equipment, or facilitated access to finance.

Does SMEDAN Give Direct Loans?

No. SMEDAN does not operate like a bank. It facilitates access to funding through verified partners.

What to Expect Realistically

Most SMEDAN-related funding opportunities:

- Target micro and small businesses

- Require verification and eligibility checks

- Are limited in number

- Do not guarantee automatic approval

Anyone promising “guaranteed SMEDAN money” is misleading you.

Who Can Benefit from SMEDAN?

SMEDAN programmes are designed for a wide range of Nigerians, including:

- Small business owners

- Medium-scale enterprises

- Startups

- Informal traders and artisans

- Cooperative groups

- Women entrepreneurs

- Youth-led businesses

- First-time founders

From food vendors and salon owners to farmers, service providers, traders, and tech startups, SMEDAN offers relevant support pathways.

SMEDAN Registration Explained

SMEDAN registration is one of the most searched topics related to the agency.

What SMEDAN Registration Means

Registering with SMEDAN places your business in the national MSME database and provides a unique SMEDAN Business ID.

Benefits of SMEDAN Registration

- Recognition as an MSME

- Eligibility for selected programmes

- Access to training and business clinics

- Increased visibility for partnerships

SMEDAN Registration vs CAC Registration

- CAC: Legal business registration

- SMEDAN: Business development and support

Both are different and often complementary.

How to Access SMEDAN Opportunities (Step-by-Step)

- Register your business with SMEDAN

- Follow verified updates through trusted platforms like NGEMPOWER

- Attend MSME clinics and training sessions when announced

- Apply only through official channels

- Avoid agents requesting payment

- Prepare documents early (ID, business details, bank information)

Patience, accuracy, and consistency matter more than speed.

Common Myths and Mistakes About SMEDAN

- “SMEDAN gives free money to everyone” – False

- Paying agents to fast-track approval – Risky

- Using fake portals – Dangerous

- Confusing SMEDAN with CAC or BOI – Common mistake

- Applying without reading guidelines – Costly error

Frequently Asked Questions (FAQ)

Is SMEDAN grant real?

Yes, but only through verified programmes.

Is SMEDAN registration free?

Yes.

Can students apply?

Yes, if they run a business.

Is SMEDAN for startups?

Yes, including early-stage businesses.

How long does approval take?

It varies depending on the programme.

Why SMEDAN Matters for Nigeria’s Economy

SMEDAN contributes to:

- Job creation

- Youth entrepreneurship

- Growth of the informal sector

- Financial inclusion

- Local production and innovation

Strong MSMEs are critical to Nigeria’s economic growth and stability.

Conclusion

SMEDAN is not a shortcut to instant money. It is a structured support system for Nigerians willing to build, grow, and formalise their businesses properly.

Understanding how SMEDAN works is the first step. Following the right process is the second. Staying informed through trusted platforms is the third.

For accurate updates, practical guides, and verified opportunities, bookmark NGEMPOWER.com and explore our SMEDAN content cluster to take your next step with confidence.

💡 Stay Empowered with NgEmpower

Join our community for daily updates on jobs, skills, and financial growth opportunities.