Across Nigeria, millions of people earn their living through small businesses. From market traders and artisans to farmers and roadside shop owners, these informal businesses support families but often struggle to access loans from commercial banks.

The Government Enterprise and Empowerment Programme, widely known as GEEP, is a federal government interest free loan programme created to help Nigerians. It was designed to support micro businesses by providing small, affordable loans to economically active Nigerians who are usually excluded from formal credit systems.

This guide explains what GEEP is in Nigeria, who it is meant for, how it works, and why it remains relevant to traders, farmers, artisans, and low-income earners.

Meaning of GEEP in Nigeria

GEEP stands for Government Enterprise and Empowerment Programme.

It was introduced by the Federal Government as part of its social intervention and financial inclusion policies. The programme operates as a federal government interest-free loan scheme targeted at micro and informal businesses across the country.

When people search for the GEEP meaning in Nigeria or ask what is GEEP loan is, they are referring to this government backed programme that provides small loans without conventional interest charges.

GEEP is managed through government institutions responsible for social investment and empowerment initiatives.

Objectives of the GEEP Programme

The core objective of the Government Enterprise and Empowerment Programme is to reduce poverty by supporting small scale economic activities.

By offering a federal government interest free loan, GEEP helps traders, farmers, and artisans access funds they would normally be unable to get from banks. The programme also aims to strengthen informal businesses, encourage repayment culture, and expand financial inclusion.

These objectives align with Nigeria’s broader economic policies focused on grassroots development, job creation, and inclusive growth.

Who GEEP Is Meant For

Market traders and petty traders

Artisans and self-employed Nigerians

Smallholder farmers

Informal business owners

GEEP is designed for Nigerians who are actively engaged in small-scale business or productive work.

The programme targets market traders, small shop owners, artisans, farmers, and informal business operators. These are people who depend on daily or seasonal income and typically lack access to traditional loans.

GEEP is not meant for salaried workers, large companies, or individuals seeking capital without an existing business. Eligibility is based on economic activity rather than academic qualifications or employment status.

This explains why questions around who qualifies for GEEP in Nigeria and who are GEEP beneficiaries are common.

Where to Find Verified Updates on GEEP

Importance of Official Sources

Official sources provide reliable, up-to-date, and authoritative information. For GEEP, these sources include:

The National Social Investment Office and related government websites

State government announcements in areas where GEEP is active

Verified press releases and statements from programme coordinators

Following official channels ensures you get the correct loan window, eligibility criteria, and disbursement procedures.

Warning Against Scams

Unfortunately, public interest in GEEP has attracted fraudulent actors. Scammers may:

Claim to offer GEEP loans in advance of approval

Request illegal fees, passwords, or personal banking details

Spread fake forms or application links

Remember: GEEP is free to apply for, and there are no upfront charges at any stage. Only trust announcements and links from verified government platforms or reputable information hubs.

Why Ngempower.com Tracks Government Programmes

Ngempower.com provides reliable, easy-to-understand updates on empowerment initiatives like GEEP.

We verify information against official government sources before publishing.

Our guides explain eligibility, application steps, and disbursement processes clearly.

We alert readers to potential scams or misinformation, keeping users safe and informed.

By following Ngempower.com, Nigerians can confidently navigate GEEP opportunities without falling for fake schemes or relying on hearsay.

Types of GEEP Programmes

The Government Enterprise and Empowerment Programme is delivered through three main components, each serving a different category of beneficiaries.

TraderMoni

TraderMoni targets very small-scale traders and vendors. It serves as an entry-level federal government interest free loan for people running micro businesses such as market stalls and roadside shops.

The aim is to help beneficiaries restock goods and stabilise daily operations, with repayment enabling access to higher loan cycles.

MarketMoni

MarketMoni is structured around groups and cooperatives. It supports organised traders, market associations, and small business groups.

By working through groups, MarketMoni encourages accountability and shared responsibility while providing access to a federal government interest free loan that supports collective business growth.

FarmerMoni

FarmerMoni focuses on farmers and agribusiness operators. It supports smallholder farmers involved in crop production, livestock, and related activities.

The programme helps improve productivity and rural livelihoods through access to interest free funding tailored to agricultural cycles.

How GEEP Works

Understanding how the Government Enterprise and Empowerment Programme (GEEP) operates helps beneficiaries avoid misinformation and unrealistic expectations. Although GEEP is widely discussed online, many misunderstand its structure and requirements.

Here is the process of getting GEEP Loan :

Identification and Verification

GEEP does not operate like a traditional online loan application where individuals apply and receive instant approval. Instead, beneficiaries are identified through community-based structures.

Potential beneficiaries are usually nominated or verified through:

Market associations

Trade groups and cooperatives

Community leaders and organised clusters

Existing government empowerment databases

During verification, basic personal and business information is collected to confirm that the applicant is economically active. This process helps ensure that GEEP loans reach traders, artisans, farmers, and small-scale business operators who rely on daily or seasonal income.

Verification may include:

Personal identification details

Business or trade information

Membership in a recognised group or association

This community-based approach reduces fraud and improves accountability.

Loan Disbursement Method

Once verification is completed and approval is granted, GEEP funds are disbursed through approved channels, often using digital payment systems.

Disbursement methods may include:

Bank accounts

Mobile money platforms

Government-approved payment agents

The loan amount varies depending on the GEEP component, such as TraderMoni, MarketMoni, or FarmerMoni. Funds are released in line with programme guidelines and are meant strictly for business or productive use, not personal consumption.

Because GEEP is a public programme, disbursement does not happen continuously. It is usually tied to specific rollout phases and budgetary approvals.

Repayment Expectations

Although GEEP is an interest-free loan, repayment is mandatory.

Beneficiaries are expected to repay the loan over an agreed period, usually in small and manageable instalments. Repayment is essential because:

It allows the programme to reach more beneficiaries

It promotes financial discipline

It sustains the long-term viability of the scheme

In some cases, repayment performance determines eligibility for higher loan amounts in future cycles. Poor repayment or default may disqualify beneficiaries from future government empowerment programmes.

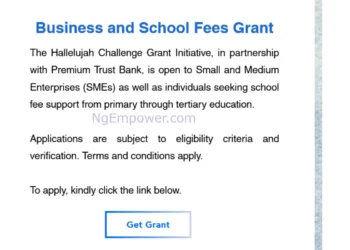

Why GEEP Is a Loan, Not a Grant

One of the most common misconceptions about GEEP is the belief that it is a free cash grant. This is incorrect.

GEEP is structured as a federal government interest-free loan, not a grant. The funds are meant to support small businesses temporarily, not to be kept without accountability.

The loan structure helps:

Encourage responsibility and repayment culture

Prevent abuse of public funds

Ensure that support reaches more Nigerians over time

Unlike grants, which are usually one-off and non-repayable, GEEP loans are designed to circulate within the economy, supporting multiple beneficiaries through repayment and re-disbursement.

Is GEEP Still Active in Nigeria

Many Nigerians continue to ask whether GEEP is still active in Nigeria.

Over time, the programme has experienced periods of active disbursement and temporary suspension due to policy reviews and administrative changes. Some GEEP components have also been aligned with broader Federal Government empowerment programmes.

While specific loan windows may not always be open, government-supported interest-free loan schemes for small businesses remain part of Nigeria’s social investment framework.

For the latest update on GEEP, Nigerians are advised to rely on official announcements and verified information platforms such as Ngempower.com.

How to Apply for GEEP in Nigeria

Applying for GEEP is straightforward if you follow the official steps. Here’s a step-by-step guide:

1. Check Your Eligibility

Must be a Nigerian citizen

Must be economically active (trading, farming, artisan work, etc.)

Must belong to a market association, cooperative, or relevant community group

2. Prepare Required Documents

Valid National ID or BVN

Proof of business activity (market receipts, photos of business, etc.)

Community or group verification, if applicable

3. Use Official Channels

Visit the official GEEP portal (link verified by Ngempower.com)

Avoid third-party or social media links that claim to process applications

4. Complete the Application

Fill in personal and business details accurately

Submit required documents online or through approved local channels

Wait for verification by programme officials

5. Track Your Application

GEEP disbursement windows vary by state and programme type (TraderMoni, MarketMoni, FarmerMoni)

Follow up through official announcements or verified sources like Ngempower.com

Frequently Asked Questions About GEEP

Is GEEP a loan or a grant?

GEEP is an interest-free loan, not a grant. Beneficiaries are expected to repay.

Does GEEP require collateral?

No. GEEP loans do not require traditional collateral.

How much money does GEEP give?

Loan amounts vary depending on the programme type and beneficiary category.

Can civil servants apply for GEEP?

GEEP is designed mainly for economically active informal workers, not salaried employees.

Is GEEP still available in 2025/2026?

Availability depends on government rollout phases and policy direction.

Conclusion

The Government Enterprise and Empowerment Programme represents one of the Federal Government’s approaches to supporting micro businesses through interest-free financing.

By understanding what GEEP is in Nigeria, how the federal government’s free loan structure works, and who the programme is meant for, Nigerians can make informed decisions and avoid misinformation.

Ngempower.com remains committed to providing clear, factual, and trustworthy information on government empowerment programmes that impact everyday Nigerians.

💡 Stay Empowered with NgEmpower

Join our community for daily updates on jobs, skills, and financial growth opportunities.